In recent years crowd sourced funding (CSF) has emerged as a legitimate alternative to traditional funding methods for privately held companies. This article will look at what CSF is and what is involved in undertaking a CSF campaign.

In Australia privately held companies have generally had limited avenues from which to raise funds for growth and expansion. Traditionally one could take a loan from a bank or raise venture capital by way of a share issue to employees, professional investors or through small scale offerings (personal offers made to only 20 investors over 12 months with a $2 million cap). A key restriction being that privately held companies could not raise funds from the public at large.

What is crowd sourced funding?

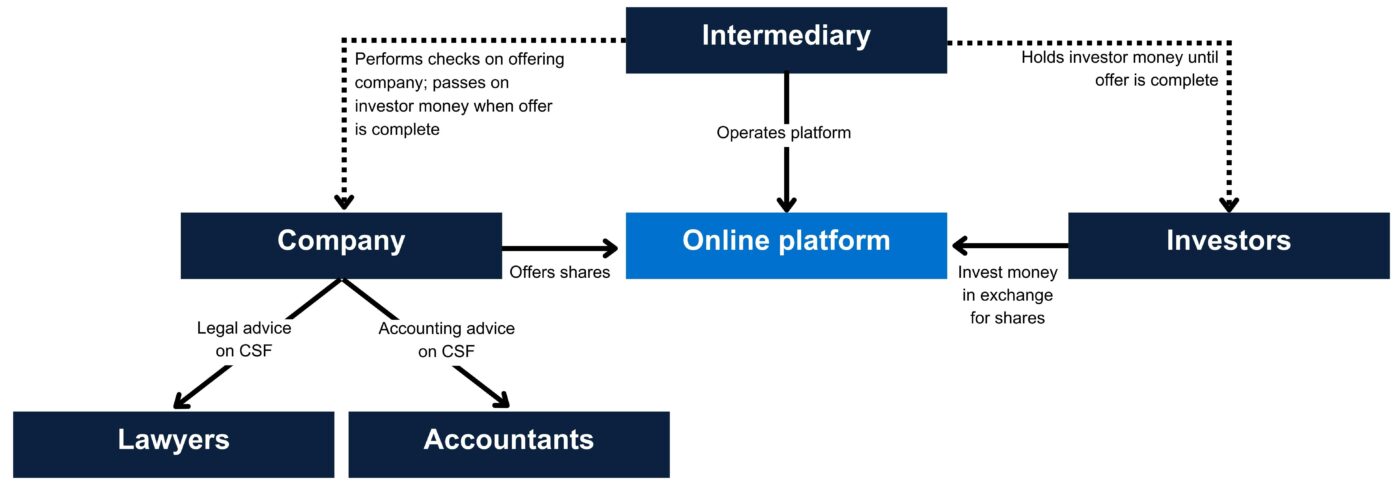

CSF allows small to medium sized privately held companies to access and raise capital from a large number of investors ie from the general public. Also known as crowdfunding, it is a method of raising capital by collecting small contributions from a large number of individuals (the crowd) through an online platform and the use of an intermediary.

The CSF regime and its framework is governed by the Corporations Act 2001 (Cth) and came into play in 2018. Since then, it has slowly been gaining more attention and traction as awareness grows and more startups and growing companies turn to it, to raise capital without relying on the traditional funding sources like bank loans.

There are various types of CSF (rewards-based, donation-based, and debt-based crowdfunding) but the most common is equity based crowd source funding which has a privately held company issuing shares to investors in return for relatively small cash investment. This is because retail investors, being the general public under the CSF regime can only invest a maximum of $10,000 in any one company during any one 12 month period.